Financial literacy campaigns trends reshaping 2024

Financial literacy campaigns utilize engaging strategies like interactive learning and clear metrics to empower individuals with vital financial knowledge and behaviors, ensuring long-term impact and community involvement.

Financial literacy campaigns trends are evolving rapidly, influencing how communities engage with crucial financial education. Have you noticed the shift in techniques and messages? Let’s explore how these trends are shaping financial understanding.

Understanding current trends in financial literacy campaigns

Understanding the current trends in financial literacy campaigns is crucial for both educators and participants. As financial challenges become more complex, these campaigns aim to provide vital information to help individuals make informed decisions.

Key Trends in Financial Literacy

Many innovative strategies are emerging to enhance financial education. Campaigns are increasingly using technology to reach audiences effectively.

- Interactive online courses

- Mobile apps that track spending

- Social media engagement

- Gamification elements to encourage learning

Moreover, partnerships with community organizations can increase the reach of these campaigns. By working together, educators and businesses can create a more significant impact.

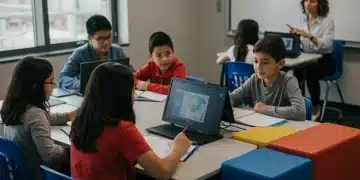

For example, workshops held in local libraries or schools have shown to boost participation. These events often provide hands-on experiences that help solidify knowledge.

Importance of Tailored Approaches

Not every approach fits every audience. Tailoring content to meet the needs of specific demographics—like teenagers, young adults, or retirees—ensures better engagement. This customization helps in addressing unique financial challenges.

Moreover, utilizing data analytics can provide insight into what strategies work best. These insights allow for adjustments that can enhance the effectiveness of financial literacy campaigns.

With the rise of digital tools, there is a growing emphasis on creating materials that resonate with varied learning styles. Visual aids, video content, and interactive modules can cater to different preferences.

Challenges in Implementation

Despite the growth in financial literacy campaigns, several hurdles remain. Resources can be limited, and not all organizations can afford to develop comprehensive programs.

- Lack of funding for innovative programs

- Finding skilled instructors for workshops

- Overcoming skepticism towards financial information

Identifying these challenges is the first step to overcoming them. Through collaboration, stakeholders can share resources and expertise.

Ultimately, understanding current trends in financial literacy campaigns allows us to adapt and refine our approaches. The goal should always be to empower individuals with the knowledge necessary for making sound financial choices.

Impact of digital media on financial literacy initiatives

The impact of digital media on financial literacy initiatives has been profound. With the rise of technology, more people are accessing financial information than ever before. Digital platforms allow for engaging content that reaches a wider audience.

Enhanced Accessibility

Thanks to digital media, financial literacy resources are now more accessible. Websites and mobile apps provide quick access to essential information.

- Online tutorials and webinars

- Podcasts educating listeners on financial topics

- Social media campaigns targeting younger audiences

- Interactive tools and calculators for budgeting

This accessibility empowers individuals to learn at their own pace, making financial education more attainable. As a result, people feel more confident in managing their finances.

Moreover, digital media allows for real-time updates. Financial news and tips can be instantly shared, keeping learners informed of trends and changes in the economy.

Engagement Through Interactive Content

Another significant benefit is the ability to create interactive content. Quizzes and games make learning about finance fun. This format increases engagement and retention of information.

By using digital storytelling, organizations can illustrate real-life scenarios. These relatable situations help individuals understand complex financial concepts better. Moreover, peer-to-peer platforms foster discussions among users, enhancing their learning experience.

Challenges to Consider

Despite the advantages, there are also challenges. Not everyone has equal access to technology, which can create disparities in learning opportunities. Additionally, misinformation can spread easily on digital platforms.

- Identifying reliable sources is essential

- Combatting financial scams online

- Overcoming digital literacy gaps among certain populations

Addressing these challenges is crucial for maximizing the benefits of digital media in financial literacy initiatives. By ensuring accurate information and equal access, efforts can lead to better financial outcomes.

In conclusion, digital media plays a vital role in enhancing financial literacy initiatives. Its ability to reach and engage diverse audiences can transform how people learn about and manage their finances.

Engagement strategies for effective financial education

Engagement strategies are key to making financial education effective. By using creativity and interaction, educators can hold the audience’s attention. The goal is to empower individuals with essential financial knowledge.

Using Interactive Learning

Interactive learning keeps participants engaged. This can be done through hands-on activities that allow for practical application of financial concepts.

- Role-playing scenarios to simulate real-life financial decisions

- Group discussions to share personal experiences and strategies

- Live polls during workshops to gauge understanding

- Online forums for sharing tips and asking questions

These strategies create a dynamic learning environment where participants feel involved and valued. It turns financial education from a mundane task into an enjoyable experience.

Moreover, integrating technology into learning can enhance engagement. For instance, using apps for tracking expenses or creating budgets can show learners how to apply concepts in their daily lives. This hands-on experience reinforces their understanding of the material.

Storytelling as a Tool

Storytelling is another powerful strategy. By presenting financial scenarios through relatable stories, individuals can see the real-world impact of financial decisions. This approach makes the learning process more relatable and memorable.

Incorporating anecdotes from successful individuals can inspire learners. Real-life examples highlight the benefits of financial literacy and motivate participants to implement what they learn. Using visuals, such as videos or infographics, can enhance storytelling and make complex ideas easier to grasp.

Incentives and Rewards

Offering incentives can also boost engagement. When participants know they will receive recognition or rewards, they are more likely to participate actively. This could include:

- Certificates of completion for workshops

- Small prizes for participating in activities

- Competitions with prizes for mastering budgeting skills

- Access to exclusive webinars and resources

Ultimately, employing a variety of strategies will cater to different learning styles and preferences. By focusing on engagement, educators can transform financial education into an enjoyable and meaningful journey.

Measuring success of financial literacy campaigns

Measuring the success of financial literacy campaigns is essential for understanding their effectiveness. To determine if these initiatives are meeting their goals, specific metrics and methods must be used. By analyzing data, organizations can refine their approaches and improve outcomes.

Key Performance Indicators (KPIs)

Establishing clear Key Performance Indicators (KPIs) is the first step in evaluation. These indicators focus on various aspects of financial literacy initiatives, providing valuable insights into their impact.

- Participation rates: Track the number of individuals who engage with the campaign.

- Knowledge assessments: Evaluate participants’ understanding before and after the campaign.

- Behavioral changes: Monitor any shifts in financial habits, such as budgeting or saving.

- Feedback and satisfaction surveys: Gather qualitative data to understand participant experiences.

These KPIs not only help gauge effectiveness but also highlight areas needing improvement. Regular analysis of these metrics will help organizations stay on track and make informed adjustments.

Another vital aspect of measuring success is setting clear goals. Defining specific objectives allows organizations to focus their efforts and measure progress effectively. Goals can be related to increasing knowledge, enhancing financial behaviors, or even reducing debt levels among participants.

Qualitative vs. Quantitative Data

Success can be assessed using both qualitative and quantitative data. While quantitative data emphasizes numerical metrics, qualitative data captures personal experiences and feelings about the educational content.

For instance, surveys can include both numerical ratings and open-ended questions. This combination provides a well-rounded view of the campaign’s impact. Understanding personal stories can highlight the campaign’s significance and inspire further initiatives.

Long-term Impact

Furthermore, measuring the long-term impact of financial literacy campaigns is crucial. Sustainable changes in behavior may take time to manifest. Track participants over several months or years to assess lasting effects.

- Monitor participants’ financial stability after engagement.

- Evaluate any changes in attitudes towards financial management.

- Assess the ongoing use of learned skills in real-life situations.

By focusing on long-term outcomes, organizations can determine whether their campaigns effectively foster lifelong financial literacy.

Ultimately, measuring the success of financial literacy campaigns requires a comprehensive approach. By utilizing a mix of KPIs, qualitative insights, and long-term assessments, organizations can create a robust framework for improvement and impact.

FAQ – Frequently Asked Questions about Financial Literacy Campaigns

What are the main goals of financial literacy campaigns?

The main goals are to empower individuals with essential financial knowledge and to encourage positive financial behaviors.

How can we measure the success of financial literacy campaigns?

Success can be measured using Key Performance Indicators (KPIs), such as participation rates, knowledge assessments, and behavioral changes.

What engagement strategies are effective in financial education?

Effective strategies include interactive learning, storytelling, and providing incentives to motivate participation.

Why is community involvement important in financial literacy initiatives?

Community involvement helps to broaden the reach of the campaigns and ensures that the content is relevant to the audience’s needs.