Inflation-Proofing Your Savings: Top 5 Strategies for 3.5% Inflation

Strategic investment in diversified assets like TIPS, real estate, commodities, dividend stocks, and alternative investments is essential to inflation-proof savings against a projected 3.5% annual inflation in 2025.

As we approach 2025, the prospect of a 3.5% annual inflation rate looms large, making the need for robust inflation proofing strategies more critical than ever. Protecting your hard-earned savings from the insidious erosion of purchasing power requires a proactive and informed approach. This article delves into the top five investment strategies designed to safeguard your financial future in such an economic climate, offering practical insights for every saver.

Understanding the Impact of 3.5% Inflation on Your Savings

A 3.5% annual inflation rate, while seemingly modest, can significantly diminish the real value of your savings over time. It means that what $100 buys today will cost $103.50 next year, effectively reducing your money’s purchasing power. This gradual erosion necessitates smart investment choices to ensure your wealth not only retains its value but ideally grows beyond the inflation rate.

Understanding this impact is the first step toward building a resilient financial planning. Many traditional savings accounts offer interest rates that fall below even moderate inflation, leading to a real loss for savers. Therefore, moving beyond conventional methods is crucial.

The Silent Tax: How Inflation Erodes Wealth

Inflation is often called a ‘silent tax’ because it reduces the economic value of currency without any explicit government levy. For investors, this means that unless their returns outpace inflation, they are effectively losing money in real terms. This is particularly true for those holding significant cash reserves or low-yield fixed-income assets.

- Reduced Purchasing Power: Every dollar buys less over time.

- Impact on Fixed Income: Bonds and other fixed-income investments may offer negative real returns.

- Savings Account Vulnerability: Standard savings accounts rarely keep pace with inflation.

Why Traditional Approaches Fall Short

In a 3.5% inflation environment, relying solely on traditional savings accounts or low-yield bonds is a recipe for financial stagnation. These instruments, while low-risk, often fail to generate returns sufficient to offset the rising cost of living. A more dynamic and diversified strategy is essential to maintain and enhance financial stability.

The goal is not just to earn a nominal return, but a real return that exceeds the inflation rate, ensuring your future financial goals remain attainable. This requires a shift in mindset from simply saving to strategically investing.

In conclusion, recognizing the subtle yet powerful impact of inflation is paramount. It sets the stage for understanding why specific investment strategies are not just beneficial, but absolutely necessary, to secure your financial well-being in an inflationary period.

Strategy 1: Investing in Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities, or TIPS, are government-issued bonds designed specifically to protect investors from inflation. Their principal value adjusts with the Consumer Price Index (CPI), ensuring that your investment keeps pace with rising costs. This makes them a cornerstone of any inflation-proof portfolio, especially in an environment of 3.5% annual inflation.

TIPS offer a unique safeguard: when inflation rises, their principal value increases, and with it, the interest payments you receive. Conversely, if deflation occurs, the principal can decrease, but it will not fall below its original par value at maturity, providing a floor of protection.

How TIPS Work to Protect Your Capital

The mechanism behind TIPS is straightforward yet effective. The principal of a TIPS bond is adjusted semi-annually based on changes in the CPI. For instance, if inflation rises by 1.75% in six months, your bond’s principal will increase by that amount. Your fixed interest rate is then paid on this adjusted principal, meaning your interest payments also rise with inflation.

- Principal Adjustment: Value increases with inflation, preserving purchasing power.

- Interest Payments: Fixed rate applied to the adjusted principal, providing higher payouts during inflation.

- Government Backing: Considered very low risk due to U.S. government guarantee.

Benefits and Considerations for 2025

For 2025, with a projected 3.5% inflation rate, TIPS offer a compelling advantage. They provide a guaranteed real return, meaning your return after inflation is positive. This contrasts sharply with conventional bonds, where high inflation can quickly erode real returns. However, it’s important to consider their tax implications, as the annual principal adjustments are taxable in the year they occur, even if you don’t receive the cash until maturity.

Despite this, the security and inflation protection offered by TIPS make them an indispensable tool for investors seeking to preserve capital and purchasing power. They are a direct and effective way to counter the inflationary pressures anticipated in the coming year.

In summary, TIPS are a powerful defense against inflation, offering a reliable way to ensure your savings maintain their value. Their direct link to inflation measures makes them an intelligent choice for investors concerned about a rising cost of living.

Strategy 2: Real Estate and Real Estate Investment Trusts (REITs)

Real estate has historically served as an excellent hedge against inflation, and its role remains crucial in a 3.5% inflation environment. As the cost of goods and services rises, so too does the value of physical assets like properties. This appreciation, coupled with potential rental income increases, makes real estate a potent tool for preserving and growing wealth.

Beyond direct property ownership, Real Estate Investment Trusts (REITs) offer an accessible way to invest in real estate without the complexities of direct management. REITs are companies that own, operate, or finance income-producing real estate across a range of property sectors.

The Inflationary Advantage of Physical Assets

When inflation heats up, the cost of building materials and labor also increases, which drives up the replacement cost of existing properties. This, in turn, boosts their market value. Furthermore, landlords can often raise rents to keep pace with inflation, providing a steady stream of income that also adjusts upwards. This dual benefit—capital appreciation and rising income—makes real estate particularly attractive.

- Property Value Appreciation: Real estate tends to increase in value with inflation.

- Rental Income Growth: Rents can be adjusted to match rising living costs.

- Tangible Asset: Provides a physical hedge against currency devaluation.

REITs: Accessible Real Estate Exposure

REITs allow investors to gain exposure to real estate without buying, managing, or financing properties themselves. They trade like stocks on major exchanges, offering liquidity and diversification. Many REITs specialize in specific property types, such as residential, commercial, industrial, or healthcare, allowing investors to tailor their exposure. Their income-producing nature means they often pay high dividends, which can also help combat inflation.

For 2025, investing in well-managed REITs in sectors with strong demand, such as data centers or logistics facilities, could be particularly beneficial. These sectors often have leases structured with inflation-escalators, further enhancing their appeal.

Ultimately, both direct real estate ownership and REITs offer robust avenues for inflation protection. They tap into the inherent value of physical assets and the ability to generate income that adjusts with economic conditions, making them vital for any inflation-conscious investor.

Strategy 3: Commodities and Precious Metals

In periods of rising inflation, commodities and precious metals have historically served as reliable safe havens. Their intrinsic value often increases as the purchasing power of fiat currencies declines. This makes them compelling components of an inflation proofing strategy, especially when facing a 3.5% inflation rate in 2025.

Commodities encompass a wide range of raw materials, from energy products like oil and natural gas to agricultural goods such as corn and wheat, and industrial metals like copper. Precious metals, primarily gold and silver, have long been recognized for their role as stores of value.

Gold and Silver: Traditional Inflation Hedges

Gold, in particular, has been a go-to asset during inflationary times for centuries. It’s seen as a tangible store of wealth that doesn’t rely on the stability of any government or financial institution. When currencies lose value, gold often gains, acting as a direct counter-balance. Silver also shares many of gold’s characteristics as an inflation hedge, often with higher volatility but also higher potential for gains.

- Store of Value: Gold and silver retain value when currency depreciates.

- Scarcity: Limited supply supports their price during high demand.

- Safe Haven: Often sought during economic uncertainty and inflation.

Broader Commodity Exposure

Beyond precious metals, a broader basket of commodities can offer diversification and inflation protection. As inflation is often driven by rising demand and supply chain constraints, the prices of raw materials tend to climb. Investing in commodities can be done through direct futures contracts, exchange-traded funds (ETFs) that track commodity indices, or stocks of companies involved in commodity production.

For 2025, with potential supply disruptions and increased global demand, commodities like oil, industrial metals, and even agricultural products could see significant price appreciation. This makes them a strong consideration for investors aiming to outpace inflation.

In conclusion, incorporating commodities and precious metals into your portfolio provides a tangible hedge against inflationary pressures. Their historical performance during periods of rising prices makes them an essential element for protecting your savings.

Strategy 4: Dividend-Paying Stocks and Value Equities

While inflation can be detrimental to some equity investments, certain segments of the stock market can thrive. Dividend-paying stocks, especially those from companies with strong balance sheets and consistent earnings, offer a dual benefit: potential capital appreciation and a growing income stream that can help offset inflation. Value equities, often overlooked in bull markets, can also present compelling opportunities.

Companies that consistently generate free cash flow and have a history of increasing their dividends are particularly attractive. These businesses often have pricing power, allowing them to pass on rising costs to consumers, thereby protecting their profit margins.

The Power of Growing Dividends

Dividend growth stocks are companies that not only pay dividends but also have a track record of increasing those payouts over time. This growth in dividends can help your income stream keep pace with or even exceed inflation. Look for companies with stable business models, competitive advantages, and a commitment to returning value to shareholders.

- Inflation-Adjusted Income: Rising dividends can counter increasing living costs.

- Capital Appreciation: Strong companies tend to see stock price growth over time.

- Pricing Power: Companies able to raise prices protect profit margins from inflation.

Unlocking Value in Equities

Value investing involves buying stocks that appear to be trading for less than their intrinsic value. These companies often have solid fundamentals but may be out of favor with the broader market. In an inflationary environment, value stocks can outperform growth stocks because their current earnings and assets are less susceptible to being devalued by future inflation. They often represent established businesses that are better equipped to navigate economic shifts.

For 2025, focusing on sectors with strong competitive moats and essential services, such as utilities, consumer staples, or certain industrial companies, could provide both stability and inflation protection through consistent dividends and potential value realization.

To summarize, a strategic allocation to dividend-paying stocks and undervalued equities can provide both income and capital growth, serving as an effective counter-measure against a 3.5% inflation rate. These investments leverage the strength of resilient businesses to protect and grow your wealth.

Strategy 5: Diversifying into Alternative Investments

Beyond traditional asset classes, alternative investments can offer unique inflation-hedging properties and diversification benefits. These include private equity, hedge funds, infrastructure, and even certain collectibles or digital assets. While often associated with higher risk and less liquidity, their potential for uncorrelated returns makes them valuable in an inflation proofing strategy, especially as inflation approaches 3.5%.

Alternative investments require a deeper understanding and often higher minimum investment thresholds, but they can provide access to growth opportunities not typically found in public markets. Their performance is often less tied to the broader stock and bond markets, offering true diversification.

Infrastructure and Private Equity Opportunities

Infrastructure investments, such as toll roads, utilities, and communication networks, often have long-term contracts with inflation-linked revenue streams. This makes them naturally resilient to rising prices. Private equity, which invests in private companies, can also offer inflation protection by focusing on businesses with strong pricing power or those that benefit from specific economic trends. These investments often provide returns that are less correlated with public markets.

- Inflation-Linked Revenue: Many infrastructure projects have built-in inflation adjustments.

- Uncorrelated Returns: Performance often independent of public stock and bond markets.

- Specific Growth Drivers: Access to unique growth sectors and private market dynamics.

Considering Digital Assets and Collectibles

While speculative, some digital assets, particularly Bitcoin, are considered by some as a potential hedge against inflation due to their finite supply. Similarly, high-value collectibles like art, rare coins, or vintage cars can appreciate significantly, especially during periods of economic uncertainty as investors seek tangible assets. However, these come with considerable volatility and liquidity risks, and should only be considered by investors with a high-risk tolerance and thorough research.

For 2025, careful selection within the alternatives space is key. Focusing on established infrastructure funds or private equity opportunities with proven track records can provide robust inflation protection without excessive speculation. The goal is to find assets that genuinely offer a hedge, not just high potential returns.

In conclusion, incorporating alternative investments into your portfolio, with a focus on those with inherent inflation-hedging characteristics, can significantly enhance your overall resilience. They provide diversification and access to unique market dynamics, which are crucial in a challenging inflationary environment.

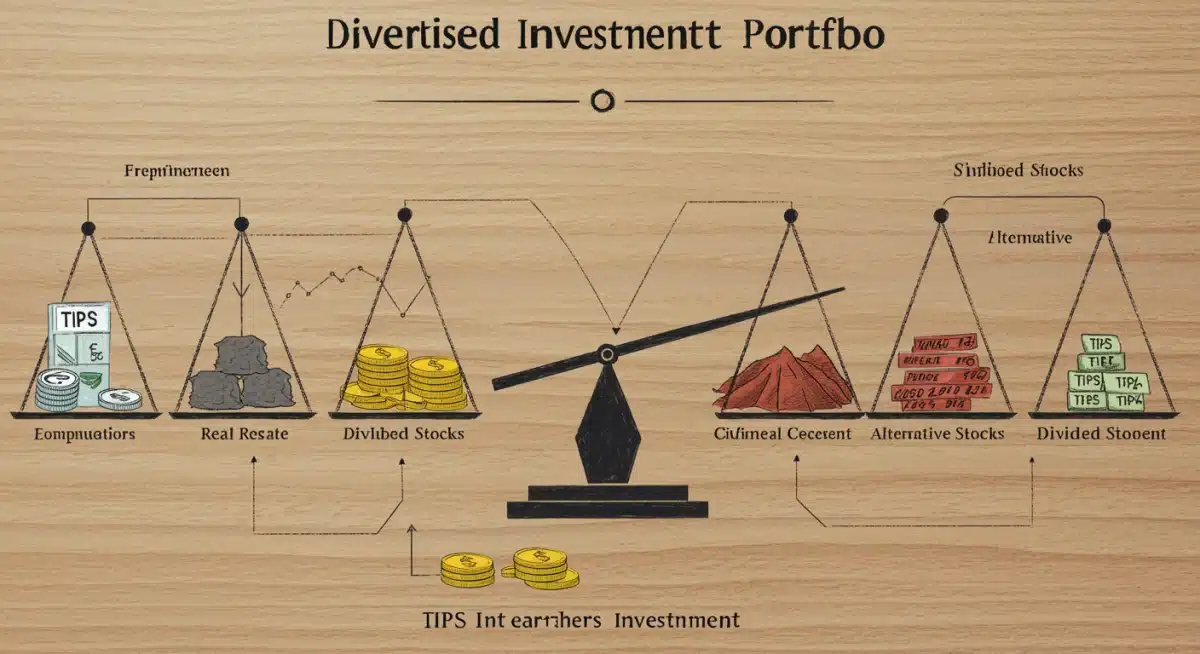

Building a Diversified Inflation-Proof Portfolio

The key to successfully navigating a 3.5% annual inflation environment in 2025 lies not in relying on a single strategy, but in constructing a well-diversified portfolio that incorporates multiple inflation hedges. A balanced approach mitigates risks and enhances the likelihood of preserving and growing your wealth in real terms. Diversification spreads risk across various asset classes, each reacting differently to economic conditions.

A diversified portfolio should ideally include a mix of the strategies discussed: TIPS for direct inflation linkage, real estate for tangible asset appreciation and income, commodities for raw material price increases, dividend stocks for growing income, and select alternatives for uncorrelated returns. The precise allocation will depend on individual risk tolerance, investment horizon, and financial goals.

The Importance of Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset categories, such as stocks, bonds, and alternative investments. In an inflationary period, strategic asset allocation becomes even more critical. It involves understanding how each asset class performs under inflation and adjusting your holdings accordingly. For instance, reducing exposure to long-term government bonds that offer low fixed rates might be prudent.

- Risk Mitigation: Spreads investments across assets, reducing overall portfolio risk.

- Enhanced Returns: Captures growth opportunities from various market segments.

- Inflation Resilience: Combines assets that historically perform well during inflation.

Regular Review and Rebalancing

Financial markets are dynamic, and so should be your investment strategy. Regular review and rebalancing of your portfolio are essential to ensure it remains aligned with your goals and the prevailing economic conditions. At least once a year, assess the performance of your inflation hedges and adjust your allocations as needed. This might involve selling assets that have performed exceptionally well and reallocating to those that are lagging but still offer strong inflation protection.

Rebalancing prevents your portfolio from drifting away from its target asset allocation due to market fluctuations. It ensures you maintain the desired level of diversification and inflation protection, keeping your financial plan on track as 2025 unfolds and beyond.

In essence, building an inflation-proof portfolio is an ongoing process that demands thoughtful diversification and diligent management. By combining various strategies and regularly adjusting your holdings, you can create a robust defense against the erosive effects of inflation and secure your financial future.

| Key Strategy | Inflation Benefit |

|---|---|

| TIPS | Principal adjusts with CPI, increasing interest payments. |

| Real Estate/REITs | Asset appreciation and rising rental income. |

| Commodities/Precious Metals | Tangible assets retain value as currency depreciates. |

| Dividend Stocks | Growing dividends and capital appreciation from strong companies. |

Frequently Asked Questions About Inflation-Proofing

The primary goal is to ensure your money retains and ideally increases its purchasing power over time, preventing its value from being eroded by rising costs of goods and services. It focuses on achieving real returns that exceed the inflation rate.

TIPS are generally suitable for investors seeking low-risk inflation protection. However, their tax implications, where principal adjustments are taxable annually, might make them less ideal for those in higher tax brackets if held in taxable accounts.

REITs offer inflation protection through appreciating property values and the ability to increase rental income in line with rising costs. This provides both capital growth and a growing income stream, helping to offset inflationary pressures.

Commodities, such as oil, gold, and agricultural products, are considered an inflation hedge because their prices tend to rise when the cost of living increases. They are raw materials whose value often appreciates as currency depreciates, preserving purchasing power.

Yes, diversification is absolutely essential. Relying on a single asset class for inflation protection can be risky. A diversified portfolio, combining various strategies, spreads risk and enhances the likelihood of maintaining and growing wealth in a challenging inflationary environment.

Conclusion

Navigating a 3.5% annual inflation environment in 2025 demands a strategic and well-considered approach to your savings. The five investment strategies outlined—Treasury Inflation-Protected Securities (TIPS), real estate and REITs, commodities and precious metals, dividend-paying stocks and value equities, and alternative investments—each offer unique mechanisms to combat the erosion of purchasing power. By understanding and thoughtfully integrating these approaches into a diversified portfolio, investors can build a robust defense against inflation, ensuring their financial future remains secure and their wealth continues to grow in real terms. Proactive financial planning and regular portfolio reviews are key to adapting to changing economic landscapes and achieving long-term financial resilience.